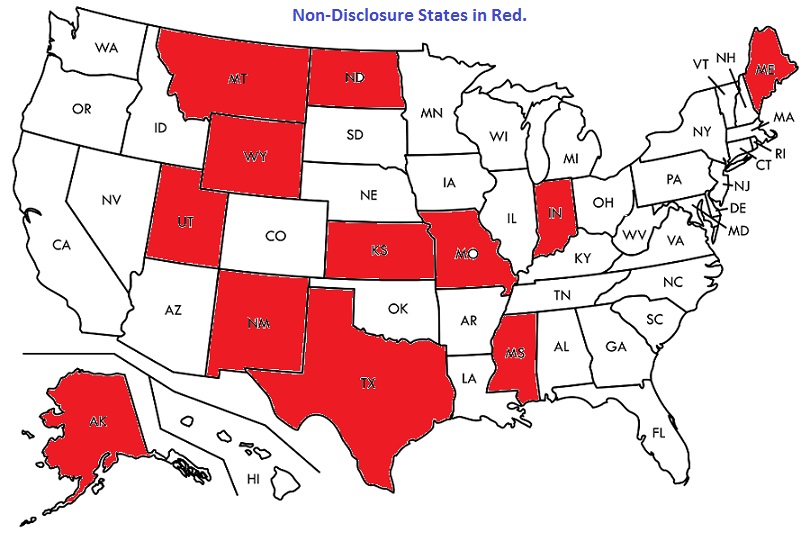

Non-Disclosure States in Red

Alaska is a non-disclosure state. That means that the price you pay for a home is not public knowledge. Under the sales price on the recorded deed of trust it will say, “for ten dollars and other valuable consideration”. Therefore you can’t go to the recording data to find the sales price.

Most states require you to report your sales price. The taxing authority in a full disclosure state knows exactly how much is paid for a house and can tax accordingly. Their appraisals on property are also much more accurate than in non-disclosure states. The map shows in red the states that are non-disclosure. All the other states require a home buyer to disclose the sales price.

Alaskan’s have historically been a people who want to mind their own business. They also want the borough to mind it’s own business. However, that could change soon.

The Mat-Su Borough, along with other local Alaska governments have chafed for years about the non-disclosure issue. They feel that they could collect more taxes if they knew the actual sales price of every sold property. They will consider a resolution in the January 10, 2017 meeting to encourage the legislature to force Alaskan’s to disclose the purchase price of a property.

There are some pros and cons to this issue:

Advantage of sales disclosure:

- People will be more fairly taxed, at least in theory. The borough will have more accurate sales information and therefore will have more accurate taxes. It won’t be completely accurate, just more accurate. For example, if you have lived in your house for ten years and made a 1,000 square foot addition the value of your property will have drastically changed since your purchased it. The borough will still need to look at recent comparable sales to determine the tax value of your home. But their comparable sales will be more accurate. We just can’t measure HOW much more accurate they will be and if that difference in accuracy is worth giving up your private information.

- Buyers will have a more accurate idea of how much to offer because they will know exactly how much you paid for your property. If you only bought your house last year for $100,000 and are flipping it this year for $200,000 they will know that.

- It would enable the state or a local government to install a transfer tax based on the sale price of a property becasue they will know the actual sale price and can tax the transfer as well as the annual property tax. I don’t think this will happen, but all government entities are looking for new revenue right now.

Disadvantages of sales disclosure:

- Your neighbors and everyone else will know exactly how much you paid for your property. You may not care, but, you may.

- The borough and the cities will know exactly what you paid and will be taxing you at that level.

- Buyers will take advantage of this information when they decide to make an offer on your house.

If this is an important issue to you, I encourage you to attend the Mat-Su Assembly meeting on January 10 in the borough building in Palmer. I believe the meeting starts at 7 but if you want to testify you might want to get their early.

If you have any questions about this feel free to call.